Blog

The Good, The Bad and The Ugly Promotions

May 14, 2021 | Chris Kervinen

Promotions can be a superb way to boost your sales numbers.

They can be in a side role without moving the net profit to one way or another. But above all, they might become outlaws and rob you the hard-earned profits without you even noticing.

A study carried out by Boston Consulting Group points out that 20 to 50 percent of B2C promotions are doing – well –nothing really. They’re those deals in store that make you wonder whether there’s truly any discount in the price, or if the manager has just printed out the price on a yellow background.

That’s 20% to up to half of the promotions being a literal waste of space in your ads. And as ads cost money, these promotions generate a negative impact business-wise.

What’s even worse is that the study found out another 20 to 30 percent of the promotions actually destroying the margins without adequate sales uplift. It’s those irresistible deals that attract bargain hunters and cannibalize normal-priced sales from other brands.

Now I know this all sounds quite dramatic. Maybe a bit too dramatic… maybe it’s just those Big Five consultants who like to pump up the numbers to look better when they roll in and optimize the heck out of the promotions…

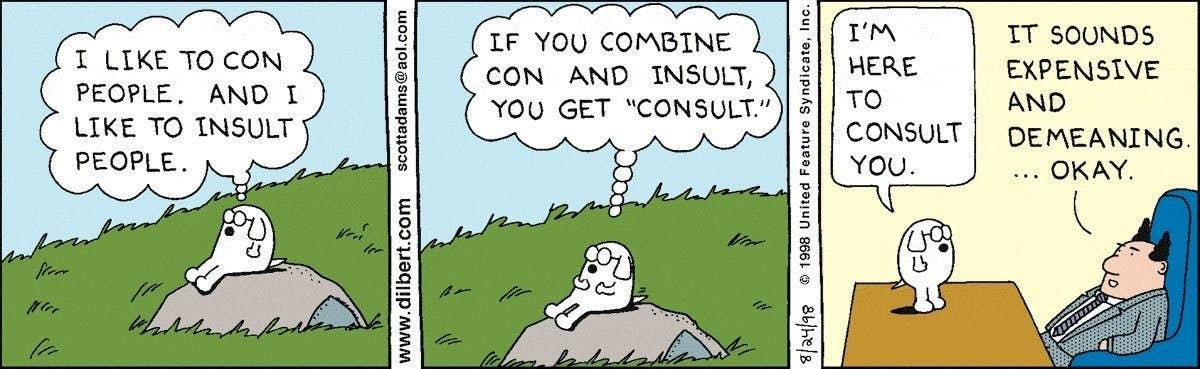

Healthy skepticism is never a bad thing when evaluating consultants’ evaluations. Comic by Dilbert.com

Of course there’s always some air in the consultants’ numbers, but unfortunately the promotion effectiveness expertise is not as easy as the managers tend to think. In the Wild West of Promotions, you have to be able to recognize what each promotion is made of.

That’s how you make every shot (or promotion) count.

The Good

We start off with the Clint Eastwood of Promotions. These are the promotions you want to have on your side. They’re unyielding, charming and relentless in terms of profit generation.

Contrary to belief, spotting these star promotions is not as easy as it would seem (especially if you’re reviewing the promotion effectiveness by considering mostly the product’s campaign sales data). Generating high sales volumes is of course a good goal per se, but only if the sales are not stolen from elsewhere and/or future.

Good promotion plan requires recognizing what are the key products to include in each ad to make it pop, as good promotions are not only effective themselves; they also increase the effectiveness of the whole ad. Because that’s what heroes do.

Good promotions improve the effectiveness of other promotions in the same ad & campaign as well.

The specifications of good promotion vary from industry to industry and from vendor to vendor, but here’s a crude breakdown of what makes promotion truly good:

· High volume uplift.

This one’s quite self-explanatory. Except that most promotion & category managers neglect the secondary effect that should also be noticed: how these traffic-driving promotions generate sales normal-priced sales. You can easily sell products even with a negative margin if the customers compensate the loss in other purchases, today or in the future. Here’s a couple hints for realizing high traffic into profit:

o Look for complimentary items that are often bought together. Sandals on sale? Remind me to get those with a couple pairs of socks.

o Try to reach the most profitable customer segments. For example, putting great salmon promotions before weekend attracts customers who seek to “buy something better for the weekend”.

o Get new customers to try out the concept. Review from time to time is your base sales (sales that would have happened without any marketing or promotions) growing between campaigns

· Low cannibalization & stock-up.

It’s also self-evident that any form of cannibalization is just plain out wrong. As is any form of hoarding. Promotion-wise these terms relate to stealing or eating away normal-priced products’ sales that takes place during and after the campaign period. Mastering the art of promotions requires understanding what net margin impact discounted price have in the big picture. A few more generic hints:

o Avoid discounting long-lasting everyday goods, unless you can compensate the lost future sales by increasing the shopping basket value with other normal-priced products.

o Analyze how Stock Keep Units’ sales have been cannibalized within the same category, when there has been a discount of any sort. Categories with high brand loyalty seem like a safe bet.

o There can be “good” kind of cannibalization – try to cannibalize sales from low-margin brands (e.g. global brands) to high-margin ones (e.g. private label brands). Part of these consumers will stick to the new brand, and provide higher margin in the future purchases.

The Bad

This category includes promotions that are somehow dysfunctional, inefficient and simply hard to like. Consisting of promotions that are not pushing the bottom-line results to desired direction, this category is not entirely a lost cause. The solution might be to modify the discount depth and tactic, depending on how other promotions have performed within this category.

Sometimes looking at how similar products and brands have thrived in promotion may reveal how to fix ineffective promotions’ discount depth and tactic.

Bad promotions’ vices can be broadly divided into two groups, of which the uninterestingness represents the cardinal sin of dysfunctional deals. Why is it such a bad thing, you might ask?

Well, because these promotions are more difficult to repair than the other type, as they couldn’t drive traffic to the stores in any way. The only applicable way to get more sales might be to cut the price even more, which is always suboptimal.

As a rule of thumb, you should consider freeing up the ad space for potentially more effective products in the upcoming campaigns.

The case might also be that the promotion is driving substantial amount of sales/traffic, but that the margin uplift is negated either by discount amount or stock-up and cannibalization within the product category. In this situation we have to carefully evaluate how to decrease the countereffect while maintaining the desired traffic uplift. The plot twist could one of the following:

Changing the discount mechanic

By switching to 3 for 2, you might be able to increase the total margin for sufficient level.

Switching to higher-margin products

In case of cannibalization, it’s good to shift the demand towards products that have sustainable price structure. Additionally, in some cases the temporary purchase decisions stick, driving even more margin in the future.

Renegotiating the trade marketing agreement (vendor funding)

Depending on the supplier, it might also be applicable to review the trade marketing arrangement and estimate if one side is benefitting more than the other.

With the right trick even the “worst” promotions can have a change of heart. Because in the end they are doing what promotions should do in the first place: Drive more sales temporarily.

But there is something beyond redemption.

Something ugly.

Promotions that are destroying the hard-earned profits are the real villains in this rodeo.

In the best-case scenario you’ll be able recognize these promotions before they dilute your margin catastrophically. But more often than you would think the retailers don’t even realize they’re running really expensive promotions in terms of margin.

This is due to the fact that each product or Stock Keep Unit (SKU) requires its own model if you want comprehensive insights about the promotion effectiveness – which is practically impossible for most retailers to apply. You’ll need either a really expensive consulting project (like BCG) or automated & continuous promotion effectiveness software (like Sellforte).

The first solution is way too expensive for most companies to run (especially on continuous basis), whereas the latter is somewhat new alternative and might require rethinking some of the planning & execution processes.

Needless to say, however, that one or the other is required in the future, as Amazon and other algorithm-driven players join the competition on local level.

Gunning down ugly promotions requires steady hands. There are some tip sand tricks to help you along the way, but at the end of the day it’s good to bring out the big guns (i.e. Sellforte) when dueling against tougher gunslingers (such as Amazon).

There are some actionable tips for spotting the ugly promotions early on, which still require rigorous analysis and consistency throughout the process:

Avoid the bargain hunters’ favorites

A peek into a shopping basket that includes the promotion item reveals whether you’re on to a winner, or just attracting bargain hunters.

Follow the money

Some promotions turn the tide with the future sales by winning new customers for the company. But if the customers are not returning for normal-priced products, chances are that your customer loyalty is promotion-oriented.

See the big picture

Sometimes spotting the bad eggs requires broader, more contextual analysis first. Try to estimate how much of the total sales is driven by the discounts themselves, and how this proportion has developed over time. If your sales seem to become discount-driven, you’ve got to rethink your promotion strategy.

And that’s pretty much about it. Keeping in mind that a great deal of promotions is not performing as well as you’d like to think, it’s never a bad idea to get hard data on the promotion effectiveness. After all, every gun makes its own tune– there’s no rule of thumb that could be applied for all promotions.

Interested to learn more about your promotion effectiveness?

Read how to implement your own promotion effectiveness analysis.

Curious to learn more? Book a demo.

Related articles

Read more postsNo items found!